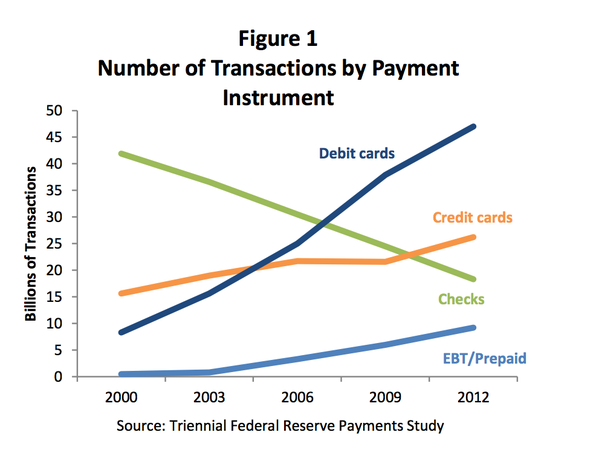

How much should financial institutions be investing in check deposit technology when checks are supposed to be going the way of the dodo? Crafting a superior mobile deposit application, or upgrading all ATMs to include Deposit Image would be a waste if within a few years checks evaporate completely.

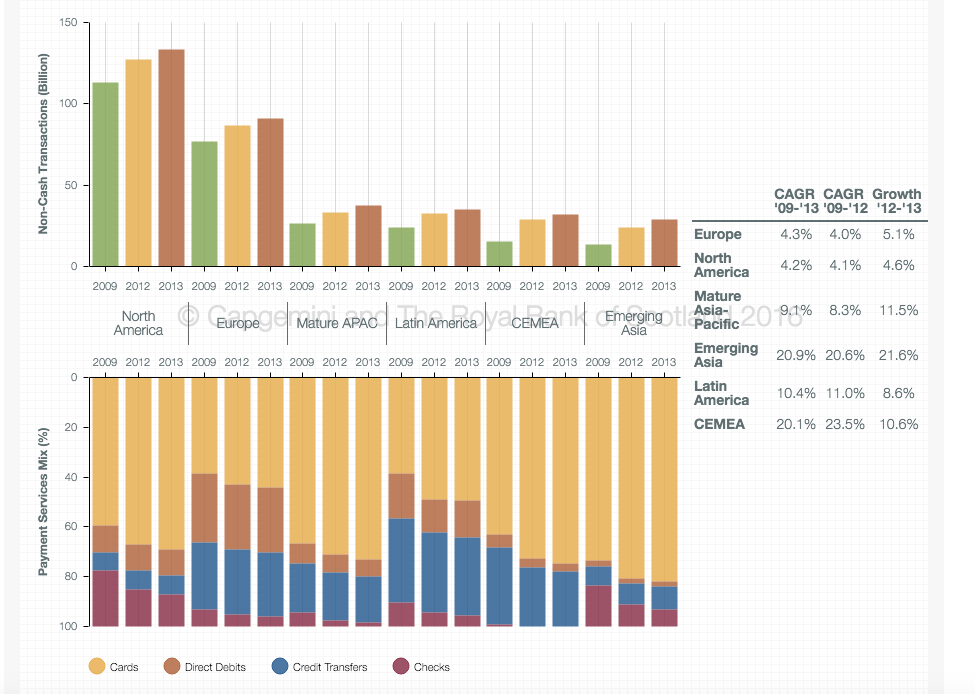

Everyone wants to get rid of checks. The process is expensive, it is batch versus real time, and if you are environmentally conscious, it is wasteful. In a world of real time, digital and self-serve convenience, checks are a dinosaur. Many European countries are leading the way and have already eliminated the usage of checks completely. The United Kingdom was scheduled to join the zero check ranks of Finland and Poland by 2018. Canada has managed to average a 5% decline in check usage every year during the past decade. The United States, however, at 15% usage is still one of the largest consumers of checks in the world.

Source: Capgemini and The royal Bank of Scotland World Payments Report 2015

Other countries have an advantage over the United States when it comes to financial payment innovation. Our free market economic philosophy is actually a hindrance. The governments of our European neighbors have greater influence in pushing economic reform while our own Federal Reserve lacks the authority from Congress. But it isn’t just a government galvanized to eliminate checks, it also has to do with the number of clearing banks we have versus the rest of the world. The United Kingdom has a total of 11 clearing banks compared to the United States at 16,000. It is a lot easier to get 11 banks into a room to agree on a migration plan with or without government support.

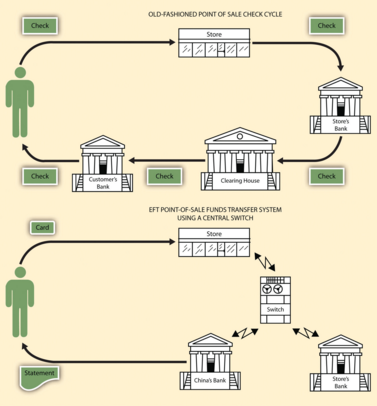

But it isn’t like we haven’t made progress in other ways. The Check 21 Act of 2003 finally allowed banks to accept digital versions of checks versus paper. No longer are banks forced to subscribe to a clearing bank, courier all the their checks to a physical location and wait for the eventual settlement. It was one of the few benefits to come out of the 9/11 tragedy. Planes were grounded and unable to move paper checks to their physical processing location, halting the flow of money. The Check 21 Act allows for checks to be digitized at receipt and the Federal Reserve acts as the main clearinghouse.

Source: 2012books.lardbucket.org

But that doesn’t mean physical checks are going away any time soon. The UK, who still has not eliminated all checks from circulation, has had to postpone their goal of 2018. And this is in a country that has a manageable number of clearing banks and is supported by the Bank England. Even if Congress gave our Federal Reserve the authority to lead the check elimination charge, we would still have to work through our 16,000 clearing banks. An aggressive estimate would still assume checks floating in circulation for decades to come.

Leading banks are still pouring money into their remote deposit strategies. Institutions like Bank of America and Fidelity are already on their 3rd generation of mobile deposit applications, while community banks and credit unions are still working through their first generation technologies. A recent study by Northcoast Research suggested that having a remote deposit strategy isn’t something that is nice to have, but a necessity to compete.

The strict limits and holding periods associated with using mobile remote deposit capture has ensured it isn’t in direct competition with ATM deposit imaging, particularly when it comes to servicing small business customers. It is no surprise that banks and credit unions have a very limited appetite for risk, and since mobile deposit capture effectively does away with the physical check, financial institutions have been leery about adopting even modest deposit limits, often doubling the hold time. This ensures ATM investment is still king in the self-serve deposit department.

At the end of the day, it is still more expensive to process checks on an individual basis in the branch. Any investment that provides consumers with the option to self-serve is going to create efficiencies as well as give customers what they want. It is an expectation that every financial institution will have some form of mobile deposit and ATM image deposit functionality. Investing in this technology ensures that we will be able to handle an expensive process in the most inexpensive way possible.

Checks will be around for years to come and our investment strategies should be tailored to ensure the greatest efficiency possible.

Informative and insightful as usual, Tom!

Thanks, Peggy! Tom and I had a great time researching this one.